Real World Asset Tokenization Development Company

White-Label Real World Asset Tokenization Platform

Unlock the future of finance with the most powerful real world asset tokenization platform. Whether you’re tokenizing real estate, infrastructure, or fixed-income assets, our ERC-3643 compliant solution ensures global investor access, legal compliance, and seamless digital ownership. Real world asset tokenization enables fractional ownership, passive income, and instant liquidity—transforming traditional assets into blockchain-powered investment opportunities. Start tokenizing your real world assets today with a platform built for security, scalability, and long-term success.

Real world asset tokenization - Our Mission

Real World Asset Tokenization Platform Features

Real World Asset Tokenization: Transforming Real Estate into Digital Assets

Primary Marketplace - Real world asset tokenization

Secondary Marketplace – Real World Asset Tokenization

Rental – Real World Asset Tokenization

Real World Asset Tokenization – Top Use Cases

Tokenized Residential & Commercial Real Estate

Real World Asset Tokenization for Infrastructure & REITs

SME Invoice Tokenization & Loan Securitization

Tokenized Bonds, Equities & Private Securities

Cross-border real estate fractional investing

Tokenization of Collectibles & Alternative Real World Assets

THE EXPERTISE IN OUR RWA TOKENIZATION SOLUTIONS

Compatible Blockchain Networks for Real World Asset Tokenization

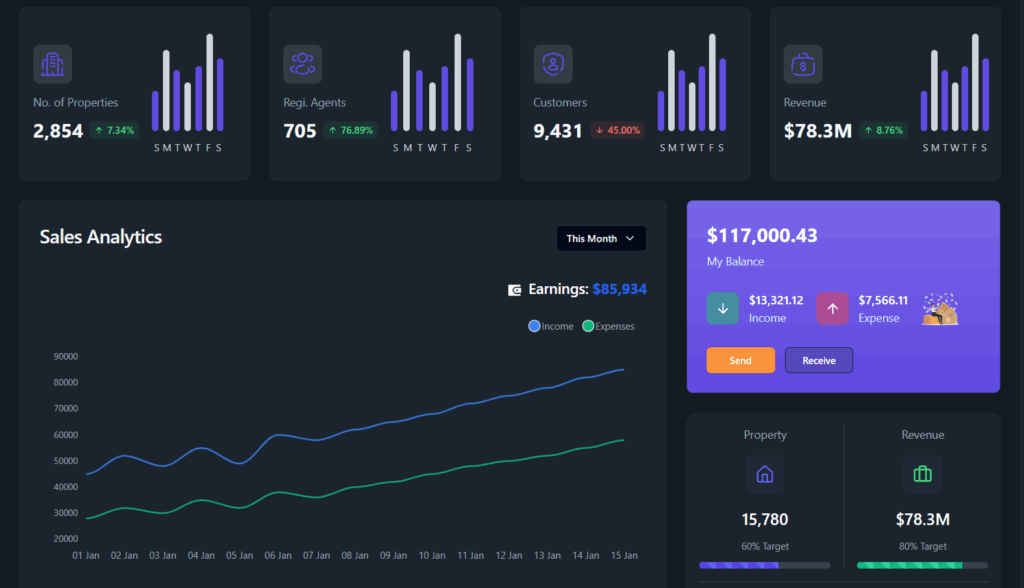

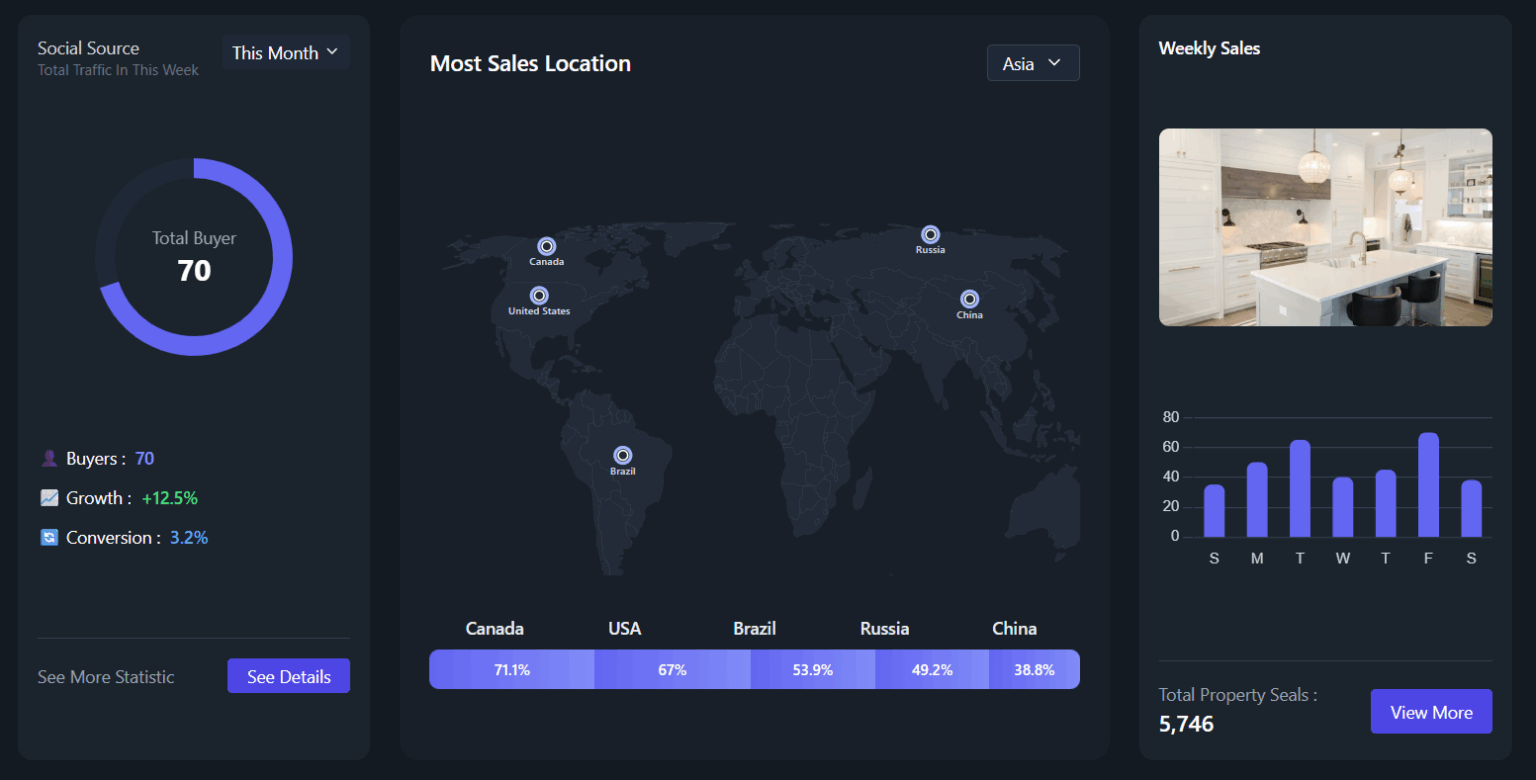

Admin Dashboard for Real World Asset Tokenization

Why Choose Blocsys for Real World Asset Tokenization?

Launch your own real-world asset tokenization platform in just 5 days — with Blocsys, the fastest no-code ready to go Real World Asset Tokenization white label solution on the market. Go live fast, stay ahead, and start earning today.

Trusted by

Frequently Asked Questions (FAQs) – Real World Asset Tokenization

Real world asset tokenization refers to converting physical assets—such as real estate, bonds, or collectibles—into digital tokens on the blockchain. These tokens represent ownership, can be traded, and enable fractional investing globally.

Blocsys includes built-in compliance features like KYC/AML verification, smart contract-based restrictions, and adherence to global regulations including ERC-3643 standards.

Yes, Blocsys supports tokenization of a wide range of real world assets including gold, art, infrastructure, invoices, and securities.

Absolutely. Blocsys offers a no-code interface that allows you to launch and manage real world asset tokenization projects without writing a single line of code.